Business Insurance in and around Monroe

Searching for insurance for your business? Search no further than State Farm agent Staci Howell!

No funny business here

- Union County

- Waxhaw

- Indian Trail

- Marshville

- Wesley Chapel

Insure The Business You've Built.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a customer stumbles and falls on your property.

Searching for insurance for your business? Search no further than State Farm agent Staci Howell!

No funny business here

Protect Your Business With State Farm

Being a business owner requires plenty of planning. Since even your brightest plans can't predict product availability or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like extra liability and business continuity plans. Terrific coverage like this is why Monroe business owners choose State Farm insurance. State Farm agent Staci Howell can help design a policy for the level of coverage you have in mind. If troubles find you, Staci Howell can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and contact State Farm agent Staci Howell to explore your small business insurance options!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

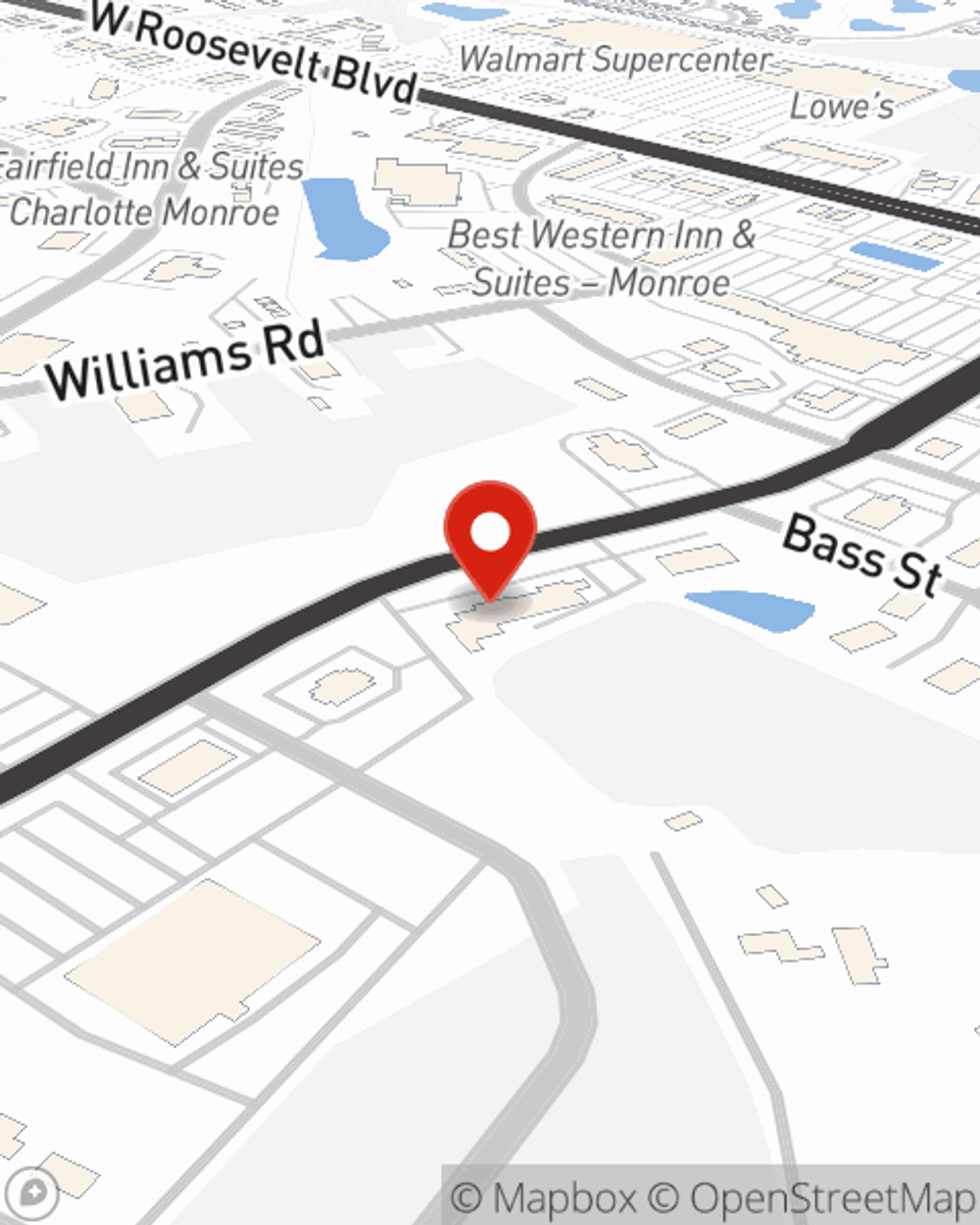

Staci Howell

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.